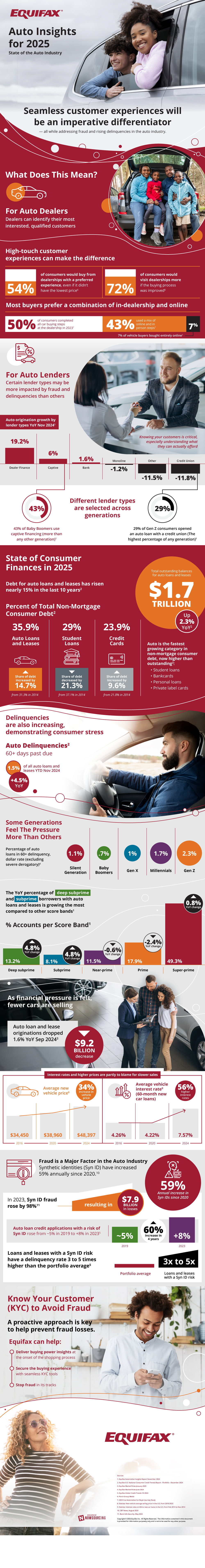

The auto industry is continuously changing, making it necessary for dealers and lenders to adapt to the resulting shifts in consumer behavior while addressing rising delinquencies and combatting synthetic identity fraud to attract new buyers. Let’s explore some new auto industry trends below.

Improving the customer experience can help auto dealers recognize their most qualified and engaged customers. More than 50% of consumers have stated they are willing to buy from dealerships that offer their preferred buying experience, even if they did not have the lowest price while more than 70% of consumers admitted they would consider visiting dealerships more if they provided a better buying process. However, most buyers like having the ability to buy a vehicle through a combination of in-dealership and online options.

Auto lenders should understand which lender types are more susceptible to fraud and delinquencies and which lender types are the most popular across generations to properly address problematic issues. For example, captive financing is mostly used by Baby Boomers while Gen Z consumers use auto loans from a credit union to buy a car.

The state of consumer finances in 2025 show that debt for auto loans and leases have jumped by nearly 15% in the past decade with the total outstanding balances amounting to $1.7 trillion. In fact, auto is the fastest-growing category in non-mortgage consumer debt, which is now higher than outstanding student loans and bank cards.

Delinquencies are also on the rise with 1.5% of all auto loans and leases being 60+ days past due as of November 2024. Delinquencies are causing stress for many, especially for Gen Z consumers who have the highest percentage of auto loans that are over 60 days delinquent.

As increased financial pressure is being felt by many, fewer cars are being sold as a result. Part of the reasons are the increasing interest rates and car prices, which have increased by 56% and 34% respectively in the past eight years.

Fraud is a big issue in the auto industry as well with synthetic identities (Syn ID) having risen by almost 60% annually since 2020. In 2023 alone Syn ID fraud rose by 98%, resulting in a financial hit of nearly $8 billion. In the past four years, auto loan credit applications with a risk of fraud have increased by 60%, and loans and leases with a Syn ID risk have a delinquency rate three to five times higher than the portfolio average.

It is now more important than ever for auto dealers and lenders to understand their customer base and implement strong preventive measures for fraud to mitigate losses and attract more buyers.